The Budget Kit: Common Cents Money Management

Household Budgeting Basics

Creating a household budget will help you to stay on track and make sure you have enough money each month to pay your bills and have money for anything extra that may come up. Here are some household budgeting basics to help you get started.

Use the computer to create a spreadsheet that will hold all of your information. You’ll need to include your income, your monthly expenses, yearly expenses, and room for anything else that may come up. These would include vehicle repairs, school costs, going out to the movies, and other things along those lines.

1. Income

The first thing on your spreadsheet would be your income. You’ll want to include everything you may have such as paychecks, secondary income, child support, bonuses, and other forms that may only come once a year like tax refunds or gifts.

2. Monthly Expenses

Monthly expenses are the next thing to add to your spreadsheet. These would include credit card payments, utility payments, loan payments, and anything else that comes up every month. You’ll want to have monthly amounts and due dates so you can place these under your income where it comes in each month.

3. Yearly Expenses

Yearly expenses may be a bit of a challenge to include, but it’s a good idea to do it. This will help you avoid the stress of coming up with the money when they come due each year. This will mean you’ll need to create a spreadsheet for each month for the entire year so you can include these types of expenses.

4. Extra’s

Extras are hard to budget for which is why you should try to plan on them each month. Putting money into a savings account will help you to have the money when the time comes. It’s nearly impossible to plan for vehicle repairs or emergencies, so a savings account will help to ease the burden when these types of things come up. You can plan on maintenance to your vehicle or yearly checkups with your doctor, but there are times when even these things don’t help, so planning ahead will help.

5. Vacations

Planning a vacation is hard to do but when you do your budget right you’ll be able to include this in your month to month budget. Your savings account will help with this plan as well. You’ll be able to see where you have a little extra money and you’ll have the ability to stick some money back so you have the ability to take a vacation when you’re ready to take one.

Creating a budget will help you to spend your money wisely and you won’t forget a thing. It’s nearly impossible to remember everything so creating a spreadsheet with all of you expenses and extra things you want will help you to maintain your budget so you can make everything happen. You’ll have the ability to see the big picture which will help you to see what you can do to increase your income and lower your expenses so you have more money at the end of the month.

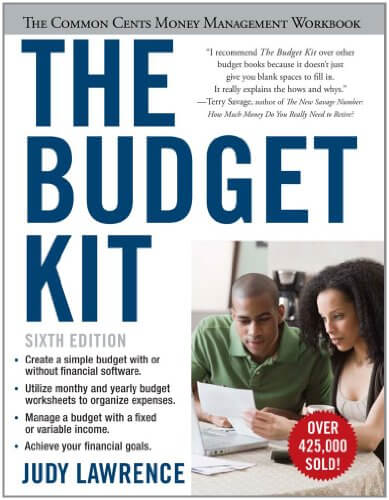

Featured Item:

The bestselling guide to getting finances under control–now fully updated and revised for these financially challenging times.

No matter your financial goal, a well-defined budget is the first step to achieving success. The Budget Kit offers consumers a foundation of knowledge, advice in reining in out-of-control spending, and necessary background information on personal investing.

Judy Lawrence, trusted budget coach and personal financial counselor, uses straightforward and easy-to-understand exercises to teach readers how to meet their financial needs and goals.

The Budget Kit is filled with practical forms and tools you can use to organize and keep track of your finances, as well as expert advice to help you:

Create monthly and yearly budgets Outline a plan for repaying debt Manage a budget on a variable income Find spending leaks Navigate online finances Track medical expenses and flexible spending accounts …and more! The Budget Kit is fully revised and now includes an updated online resource guide that directs readers to helpful websites for additional information on spending guidelines, credit card debt, and recovery issues.

With Judy’s tried-and-true guidance, you can get your spending under control and create a budget that will put you on the road to financial freedom!